We Owe Sephora Kids an Apology.

I surveyed over 500 teens to unpack their beauty habits, brand loyalty, and what’s in their Sephora carts.

Part II of this article relates to beauty trends, part I took a closer investigation into fashion and clothing trends.

This week, I surveyed a pool of young people born between 2000 and 2014 (a mixture of both Gen Z and Gen Alpha) to get an understanding of what these age ranges value in terms of beauty consumption. What beauty trends are they loving right now? What are their friends using and recommending? And what’s just starting to bubble up? I set out to explore these questions, and the responses were interesting.

As someone who runs a fashion & beauty account on both Instagram and Snapchat, I am always in direct communication with what young people (mainly young girls) are wearing, buying and experimenting with in the beauty space. It’s funny to think about how much things have changed — when I was a preteen, my bedroom shelf was filled with My Little Pony figures, not serums and setting sprays. But that’s no longer the case for today’s youth. Now, I regularly get requests for makeup wish-lists around Christmas, the best blushes to wear to school, which mascaras won’t get them in trouble with teachers, and even how to convince their parents to give them more than $50 for a mall trip with friends (this might be the only relatable one, except I needed money for snacks and they want money for Charlotte Tilbury). The shift in beauty habits is real — and honestly, I find it fascinating because why should this next generation be shunned when this is where beauty is headed?

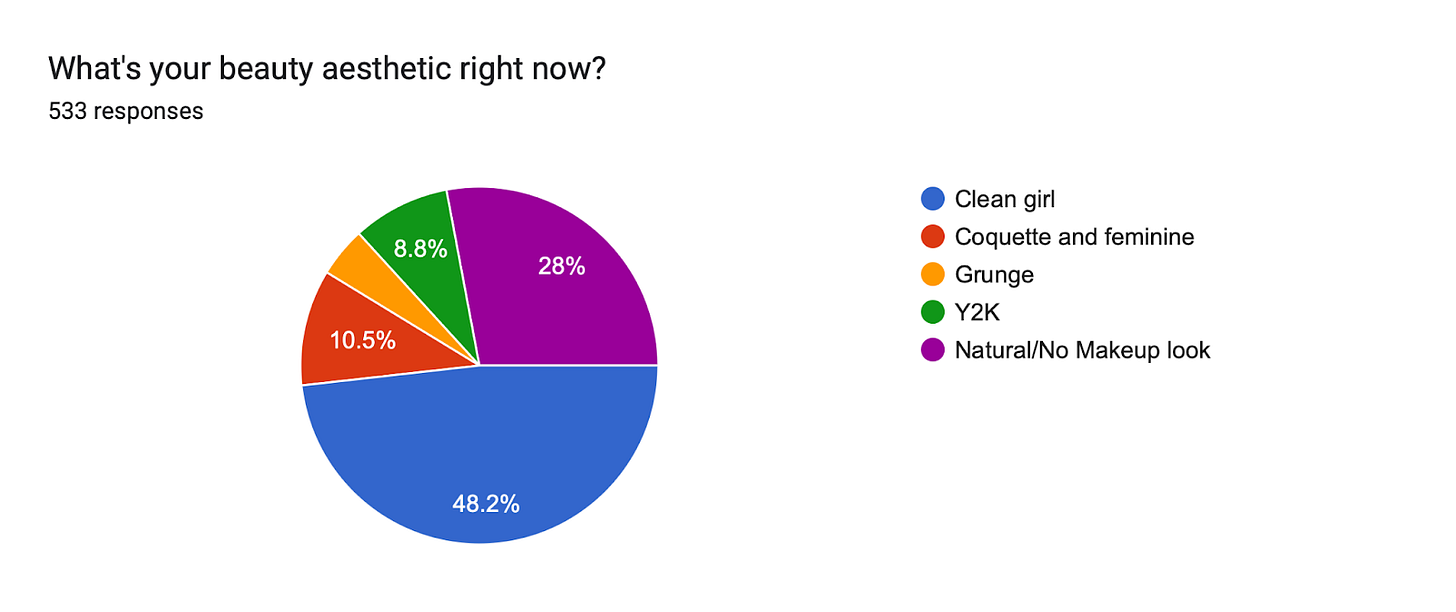

What’s your beauty aesthetic right now?

We are living through the peak of the “clean girl” era. And for Gen Z, it is no longer a fun trend— it’s an aesthetic, a lifestyle, and a cultural signal. From Pinterest Shuffle wish lists to TikTok GRWMs (Get Ready With Me videos), the clean girl look is everywhere. Think slick-back buns, glowy skin, tidy gold hoops, perfectly tailored basics. The look is meant to be perceived as effortless, tidy, and polished — a soft glamour that feels low maintenance (even if it isn't). And like I said in the introduction to this post, I am in constant communication with young girls and I can tell you - the girls want to be “clean girls”. Nearly half of those I surveyed, aged 11 to 25, feel the same way.

The next biggest preference? “Natural/no makeup.” So, the message is clear: today’s youth are leaning into simplicity, relatability, and routines that look effortless. Take Katy Fang, for example, a TikTok creator with over six million followers, known for her ultra-relatable persona and easy-to-follow makeup routines. Her influence is immense and many find her appealing because she’s not selling glam; she’s selling attainability. The kind of beauty that feels like it could be yours with the right concealer and a good blush.

This shift away from the heavy makeup looks of the early 2010s - with intense contouring, overdrawn brows, and full glam faces - is more than just stylistic. Some argue it’s connected to broader cultural forces like:

Economic uncertainty (clean, minimalist beauty is often recession-coded; think 2008 and the rise of no-makeup makeup).

A move toward conservative femininity in Gen Z’s aesthetic circles.

A reaction to burnout — simplicity in beauty is part of a larger desire for slower, more intentional living.

What is your favourite beauty brand/s?

Here are the top 20 beauty brands which were mentioned:

Key Insights:

Celebrity beauty brands still dominate — Rare Beauty, Fenty, Rhode — but they're all pushing more natural or “real skin” looks (possibly for product-market fit in 2025).

Accessibility matters — brands like ELF, Essence, and Maybelline are beloved not just for price points but because they are worth the investment.

Skin-first beauty is booming — Glow Recipe, Byoma, Bubble, and The Ordinary all show that Gen Z/Alpha see skincare as a core part of their beauty identity.

Pinterest and Friends/Family take the reins for the being the most popular sources of beauty inspiration for Gen Z and Gen Alpha. TikTok stays closely behind:

Where are you going to buy these products?

These results varied based on where the respondents lived geographically so here is a breakdown because what do you do with a pie chart that looks like this?

Top destinations across all regions:

Sephora – still the ultimate beauty playground (especially if you remember the Sephora kid phenomenon).

Ulta Beauty – huge in the US, with drugstore-to-high-end options.

Mecca Maxima – an Aussie fave, and rising fast with younger shoppers.

Regional mentions also stood out:

Australia/NZ: Priceline, Chemist Warehouse

UK: Boots, Superdrug

Europe: DM

Globally: Amazon and other online retailers — showing how e-commerce is becoming beauty’s real front door.

I do feel that shopping habits may shift as new players emerge, like TikTok Shop, or as influencer-owned DTC brands build loyal followings outside traditional retail. It’s only a matter of time and it would do well if these influencers understand their audience and are solving for a gap in the market, not just by slapping their name on a product (just my opinion because we might be reaching celebrity-beauty brand fatigue).

How Much Money does Gen Alpha (or their parents) spend on beauty?

To understand the spending habits of Gen Alpha when it comes to beauty, I asked participants how much money—either their own or provided by parents/guardians—they typically spend on beauty products. The majority, 45.6%, said they spend between $50 and $100, while 40.3% spend less than $50. A smaller group, 12.4%, spend between $100 and $200. That leaves just 1.7% who spend more than $200 on beauty.

This suggests that most Gen Alpha consumers are shopping with relatively modest budgets, often under $100, which may reflect the influence of limited income, allowance-based spending, or thoughtful budgeting, even when highly influenced by trends and online beauty culture.

Now we know where they shop and their favourite brands, which beauty category do they shop for the most?

When asked which beauty category they purchase from the most, the results were loud and clear: makeup is still the top contender.

But that is just the headline.When we zoom in and look at the specific products within that category, a clearer picture starts to form — one that reveals how Gen Z and Gen Alpha approach beauty today.For them, it’s clearly not just about buying makeup but more so curating a look that aligns with identity, lifestyle, and aesthetics they’re exposed to online.

This generation is less focused on transformation, and more focused on enhancement. They want products that help them look like themselves — just a little more polished, radiant, or awake. This ties directly into the rise of skin-first beauty, mental health awareness, and a deeper desire to “glow from within” (both literally and figuratively).

Even those who identify with more maximalist aesthetics (like coquette or alt makeup) still often default to these basics in everyday routines — proof that minimal doesn’t always mean boring; it just means curated.

What is at the top of your beauty wish list?

A full breakdown of results in order of highest frequency from the survey results. It is incredible how well-educated young people are in terms of the options available to them compared to when I was growing up and makeup was seen as a “grown up thing”:

Blush

Rare Beauty Blush (especially “Happy”)

Patrick Ta

ELF Jelly Blush

Cream & liquid blushes

Setting Spray/Powder

Charlotte Tilbury Airbrush Setting Spray

Urban Decay

Huda Beauty

Lip Products

Glossier lip liner

Rhode Lip Peptide Treatment

Clarins Lip Oil

Dior Lip Oil (younger me could only ever dream)

Tower 28

Fenty Glosses

Concealer

NARS

Tarte

ELF Cosmetics

Merit

Mascara:

Sky High

Pillow Talk

Telescopic

Refy

L’Oreal

Perfume/Body Mists

Dior

YSL

Victoria Secret

Glossier

Carolina Herrera

Gucci

Billie Eilish

Bronzer/Contour

Saie Sun Melt

Charlotte Tilbury Cream Bronzer

Makeup by Mario Contour Stick

Rare Beauty Bronzer

Skincare

La Roche-Posay

Bubble

Glow Recipe

Anua Heartleaf Toner

An overall desire for clear skin

Haircare

Dyson (Airwrap & straightener)

Gisou Hair Oil

WOW Frizz protectant

Curly hair products

Not Your Mothers Curl Talk

More Eyelash Products

Lash serum

Eyelash curler (Shiseido, Dior)

Eyelash primer

Foundation/Skin Tint

Charlotte Tilbury Flawless Filter

Fenty Skin Tint

Milk Makeup

What are their motivations for purchasing beauty products?

Here is a chart of the key themes which reveal why Gen Z and younger consumers make beauty purchases:

Other Factors:

Loyalty & Familiarity

Used it in the past – Sticking with trusted products.

Rebuying favourites – Repurchasing items that worked well before.

“Tried and true” essentials – Restocking go-to, reliable products.

Brand trust – Choosing brands with a strong reputation.

Social Influence & Recommendations

Friend recommendations – Influence from peers and social circles.

General recommendations – Advice from trusted sources, both online and offline.

Reviews – Valuing opinions and experiences of other users.

“A lot of people use it” – Choosing popular products for reassurance.

What others say about it – Seeking external validation before buying.

Makeup-Specific Preferences

Shade options – Wide range of colours and tones is important.

Colour variety – Desire for makeup that matches personal style.

Skincare-Driven Decisions

Skin-specific needs – Buying based on current skin concerns (e.g. pimples, dryness).

“What my skin needs” – A targeted, problem-solving approach.

Testing & Quality

Trying before buying – Preference for testing in-store before committing.

Product quality – Seeking effective, high-performing products.

“How well it works” – Focus on tangible results.

Practicality & Necessity

Price sensitivity – Being mindful of affordability.

Necessity – Sometimes it’s a straightforward need-based purchase (“because I need it”).

Health-conscious – Choosing products that are “good for you” or promote wellness.

Visual Appeal

Packaging and design – Drawn to aesthetically pleasing products. Especially if all the products follow a specific colour scheme for GRWMs.

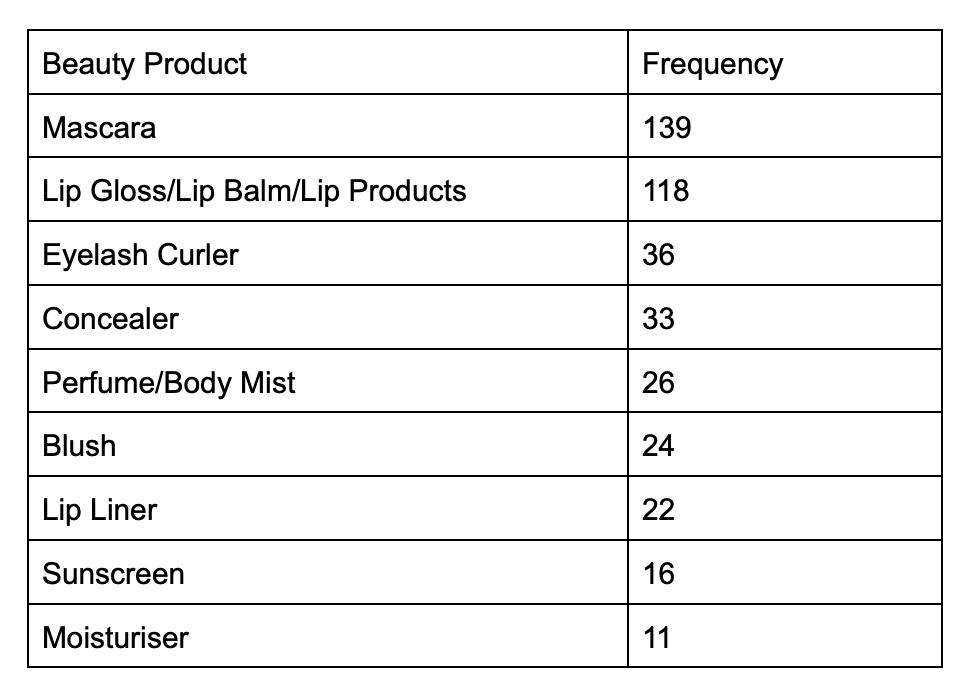

What is one (or a few) items you cannot leave home without?

Today’s consumers (especially Gen Z and Gen Alpha) have products they swear by and “cannot live without” which they rely on for confidence, minimal routines, or on-the-go-beauty. I would love for brands to turn this behaviour into loyalty and sales with smart positioning, portable formats, and “hero product” marketing. Here is a breakdown on the most commonly mentioned beauty products on the hot list:

Other Notable Mentions:

Powder

Brow Gel

Highlighter

Vaseline

Hair Oil

Understanding the core “never leave the house without” products reveals more than just consumer preference — it shows routine, loyalty, and purchase priorities.

For beauty brands, this insight offers several clear, actionable opportunities:

Bundle Essentials: Young consumers know exactly what works for them but are often price-sensitive. Offering affordable product bundles (e.g. mascara + lip balm + concealer) directly appeals to their daily routines and helps them save — increasing brand loyalty and basket size.

Hero Product Focus: Mascara and lip products consistently top the list. Brands should invest in hero product storytelling, marketing these staples as must-haves in every kit — with targeted messaging across platforms.

In-Store & Mini Formats: Travel-size, pocket-friendly versions of these essentials cater to the “always on the go” mindset. Gen Z loves convenience, so having minis at checkout or in-store displays can drive impulse purchases.

Cross-Promotions & Collabs: Partner with fragrance or skincare brands to create cross-category kits (e.g. lip gloss + body mist, or concealer + SPF) that meet multi-step needs in one value pack.

Content Strategy: Build your content around these “can’t live without” products. Highlight them in tutorials, routines, GRWM-style reels, and influencer content — especially those tied to busy lifestyles, quick fixes, or daily habits.

Conclusion

It’s clear that young girls are intentional about the beauty products they use daily — with mascara and lip products leading the way. But beyond function, they’re drawn to brands that reflect positive values, ethical practices, and strong visual appeal. In 2025, the line between digital presence and real-life identity is increasingly blurred, and beauty choices are now as much about personal expression as they are about routine. These preferences reveal more than trends — they speak to how young people want to show up in the world.

If you’re interested in a detailed report, full dataset, or deeper insights tailored to your brand or campaign, feel free to reach out. I’m happy to share custom breakdowns, trend analysis, and actionable recommendations based on this research.

Contact: threadloopfits@gmail.com

Thank you for reading, let me know your thoughts. God bless x

I love your articles but damn they make me feel ready for the grave. I’m 34 and as a teen my make up consisted of dream matte mousse and a black pencil I never full removed, just kept re-applying. The idea of skin care? St Ives scrub baby.

This reporting deserves a Pulitzer! 🔥🪩